Land contracts have been around for a long time.

If you can’t get a mortgage, they can look like a good alternative to becoming a homeowner. You put some money down, and pay the owner of the house in installments over time.

But unlike a mortgage, you don’t actually get the deed until the contract is paid in full.

And these deals can be problematic for home buyers. They’re largely unregulated, and if you’re not a savvy consumer, or you don’t have a lawyer who can look it over, a land contract can be bad news.

Click here to listen to Reveal's look at the decline in homeownership, and who's profiting from it.

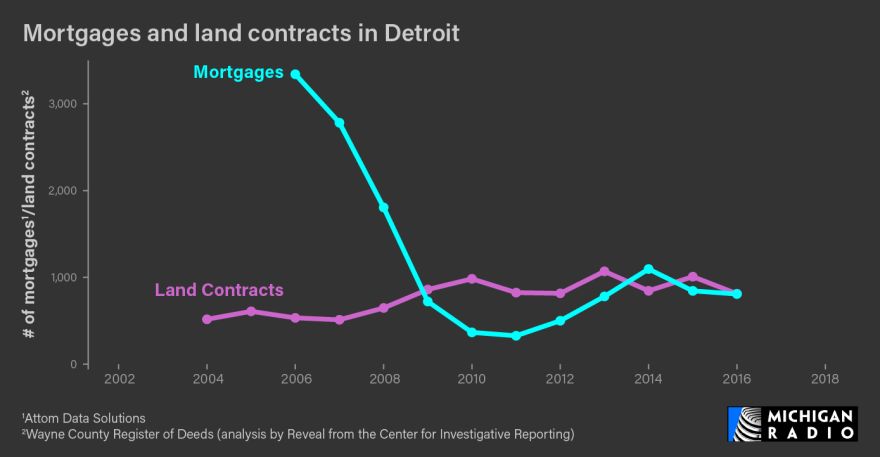

So why was Detroit primed to become a place where predatory land contracts could take hold? For one thing, it's a community that didn't have great access to credit, even before the housing crash. We looked at how the number of mortgage originations in Detroit compared to cities of similar populations, and it's easy to see why many observers call the city a "credit desert."

So lots of folks in Detroit are locked out of the traditional mortgage market. Then came the housing crash. Tens of thousands of families lost their homes to the banks. That was true in lots of places. But in Detroit, there was a second foreclosure wave: According to Loveland Technologies, since 2009 more than 100,000 homes in Detroit have gone into tax foreclosure.

Those foreclosure waves created a huge inventory of homes, and an opportunity for investors – who scooped up big bundles of properties from Fannie Mae and Wayne County.

Related: The winners and losers of Grand Rapids' housing boom

Once vacant, many of these homes quickly got stripped and slipped into disrepair. Selling the homes on the traditional mortgage market wasn't an option – no bank would lend money for homes of such low value and in such bad shape. Many properties sold for cash. But some investors – including big firms backed by private equity and smaller, local outfits that saw opportunity – saw land contracts as a good way to unload many of those low-value properties.

It's important to note that in Michigan, like most states, there is no law that requires land contracts to be recorded. So it's likely that the records from the Wayne County Register of Deeds vastly understates the number of land contracts in Detroit.

Legislation being drafted by state Sen. Steve Bieda would require those contracts to be recorded. Housing advocates are also pushing for regulations including:

- Requiring the disclosure of liabilities on a property, like back taxes or water bills

- Requiring an appraisal, so buyers are not purchasing homes at wildly inflated prices

- Requiring title insurance or a title check

- Requiring annual statements and amortization tables

But those same advocates also warn that shady operators are nimble, and can quickly pivot in the face of new regulations. In fact, that's already happening. Some investors have dumped land contracts in favor of "lease with option to purchase" agreements that can be even more problematic for would-be homeowners.