Last year, 876 people died in Michigan car crashes, according to the state police.

Another 71,000 were injured.

Some of those injuries were catastrophic, leaving people with lifelong brain damage, in wheelchairs, or hooked up to ventilators.

And Michigan's no-fault auto insurance law provides all catastrophic victims with a lifetime of unlimited medical benefits.

But the legislature is fast-tracking changes to that law that have doctors, victims and their families worried.

One young man’s story: from science prodigy to struggling with brain damage

Sam Howell's mind was always a little different, says his mom, Maureen Howell.

"When he was 15, he started researching a disease that his sister had. He was a very brainy child, kind of a nerd, and he would take biopsies of her tumors and go to our local university, Saginaw Valley State University, every night and work in the labs."

That work won him first place in biochemistry at an international science fair and thousands of dollars in scholarships.

"I couldn't speak yet, and I had to be turned by my parents 24 hours a day. And slowly the recovery came back."

But then, when he was 18, Sam Howell’s car went off the highway, vaulted off of a snow bank 10 feet into the air, and hit a tree.

He was in a coma for two months. When he woke up, his brain was permanently damaged.

"I couldn't really move very much,” he says, now in his late 20’s. Howell’s speech is labored, hard to understand at times, and he’s blind in one eye. But he can walk with the help of a cane and he’s come a very long way.

“I couldn't speak yet, and I had to be turned by my parents 24 hours a day. And slowly the recovery came back."

Maureen Howell says a huge part of that recovery was the rehab facility they got Sam into, which they could only afford because of Michigan’s no-fault auto insurance.

Here’s how Michigan’s no-fault auto insurance works

Michigan is the only state that does it this way, with a catastrophic claims association.

Every car in Michigan has to have no-fault auto insurance.

And when you pay your premiums, $186 goes into a medical fund for major car crash victims. It’s administered by the Michigan Catastrophic Claims Association.

That fund, over the years, has grown to $20 billion.

And whenever catastrophic car crash victims like Sam wrack up medical bills over $545,000, that fund kicks in and covers their bills.

That's how people like Sam can get a lifetime of medical care, which his mom says he need 24/7.

"Sam has five therapists. He’s still continuing to do physical therapy. He still gets cognitive therapy,” she says, adding that Sam also occasionally goes into pituitary shock and needs emergency medical injections in order to survive them.

Among the proposed changes: a cap on what doctors can bill

Auto insurers have been trying to change Michigan’s system for years.

Because while they get reimbursed by the catastrophic claims fund once medical costs go over half a million dollars, they're on the hook for the charges before that cap is reached.

Now, the state Legislature is fast-tracking a new bill that would cut a lot of those costs.

It would put a cap on how much doctors are allowed to bill auto insurers for the care provided to people like Sam Howell.

The cap? No more than 150% of the rate Medicare pays for the same service.

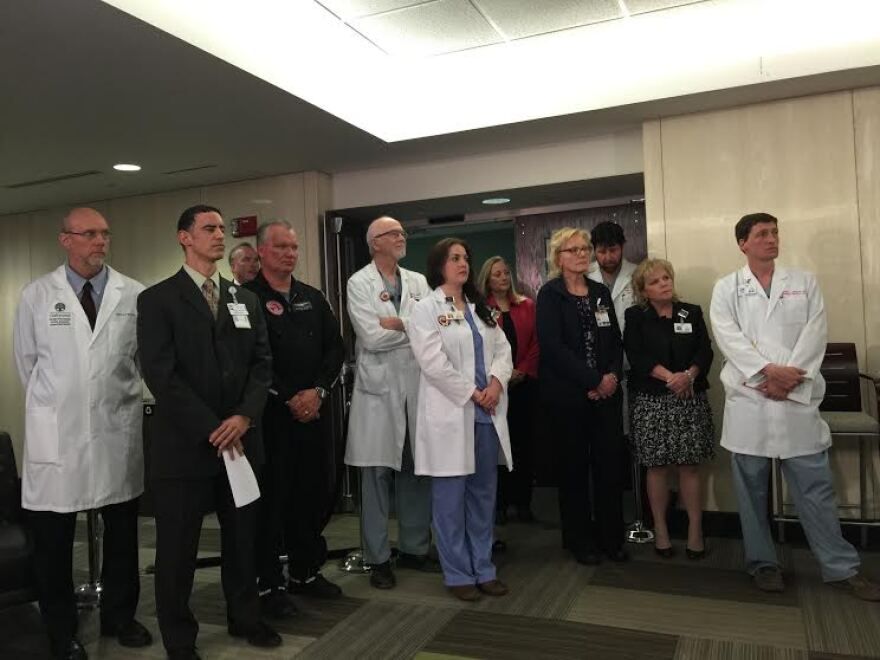

That might sound generous, but it's not, says Dr. Randy Janczyk, who runs the trauma center at Beaumont Hospital.

"150% of an amount that's not enough to care for a person, isn't a good deal."

Dr. Janczyk says Medicare reimbursements often don't even cover what it costs the hospital to treat Medicare patients.

And that trauma patients often need far more expensive and intensive types of care than Medicare offers.

Meanwhile, Michigan's hospital association is freaking out over these possible cuts. They say it could cost them $1 billion in trauma reimbursements every single year.

And Dr. Janczyk says that will have a big effect on what kind of trauma care we have in Michigan for anyone, not just car crash victims.

"Bottom line is, trauma care would suffer. If we don't have these monies in place, the way it's been funded, it can have a detrimental effect on the whole system."

For insurance lobbyists, this is about finally making things fair

So I called up the insurance lobbyists and said hey, these doctors and patients seem to pretty clearly think that you're the bad guys here

"Well first off, I gotta tell you I'm very concerned with the misrepresentation and the overstatement of facts that we have going on around this debate,” says Peter Kuhnmuench. He runs the Insurance Institute of Michigan.

And he says look, all they're trying to do with this law is make things fair.

Because right now, doctors have set fees that they can charge Medicare or worker’s comp.

But with the no fault law? The auto insurers have to pay whatever doctors want.

And that's leading to them being way overcharged, for, say, a CT scan.

"Auto insurers pay upwards of 32 hundred dollars for that CT scan. While others payers such as worker's comp pay under a thousand dollars,” says Kuhnmuench.

“And that's what we're trying to get at. We think if we can reduce the charges, make 'em a little more in line with what everybody else pays, that our consumers will benefit from lower premiums as a result of that."

So I asked him about what Dr. Janczyk said: That Medicare often doesn’t cover some of the expensive, intensive, years-long recovery treatments that trauma patients need.

"So the question becomes: how much (will insurance companies pay for those treatments)? And if there's not an applicable Medicare charge for that, then obviously that has to be negotiated between the health care provider and the insurer."

But how would those negotiations work? What's to guarantee that auto insurance companies wouldn't just say, no we're not covering it?

Nothing in the bill clarifies this, or even says the negotiations have to happen in the first place.

Meanwhile Sam Howell and his mom, Maureen, are worried that the insurance companies could interpret these new changes to be retroactive.

Meaning that Sam's care - his therapists, the 24/7 attendant care - would be limited to 150 percent of what Medicare charges.

Maureen Howell says that's her biggest fear.

"As long as I'm alive, Sam's gonna be ok. It's after I'm gone that I worry. I feel like I can't even die in peace!” she says, laughing. “So I do worry about his future without me. But also I worry about who's next coming down the pike."

The Michigan State Senate already passed these changes. The House may vote on them this week.

If they do make these changes, your premiums might go down over the long haul.

But your benefits definitely will.